The information being provided is strictly as a courtesy. When you link any of these websites provided herewith you are leaving this site. Our company makes no representation as to the completeness or accuracy of information provided at the sites. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, sites, information and programs made available through the site. When you access one of these sites, you are leaving InFocus Financial Advisors’ website and assume total responsibility and risk for your use of the sites you are linking to.

SubmitIs Diversification Dead?

So far this year:

Through November of 2018, nearly 90% (63 of those 70) of those asset classes are negative in U.S. dollar terms.

Point being, there weren’t too many combinations of assets this year that wouldn’t have lost you money. That statistic is incredible on its own, but to top that, this is the largest amount of assets losing money at the same time since 1901. So, what does that mean? Should we go back to chasing the top performing asset class this year? It’s U.S. stocks by the way, making that decision all the easier for some.

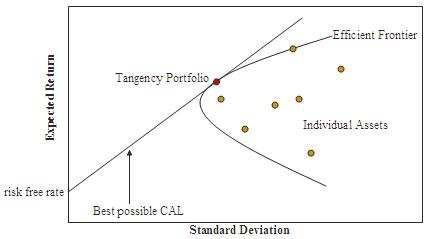

Investing in a diversified portfolio has been, is, and will continue to be a difficult endeavor. Looking at some statistics from Blackrock in a recent research piece shows why diversification is never the most attractive option. From 2000-2002 a diversified portfolio of global stocks and bonds lost 13%. In contrast, domestic stocks (S&P 500) here at home lost 37.6%. Nearly 3 times as much. You were probably happy to be diversified, but it’s a hard thing to say, “at least we’re not down as much.” We expect diversification to sometimes be far too strong of a buoy against any kind of loss or loss at all. How about the upside? When you look at the subsequent 4 years from 2003-2007, the globally diversified portfolio was up 57.8%. However, the S&P 500 over the same period went up nearly 82.9%. A diversified portfolio lagged U.S. stocks by a wide margin of nearly 30%. That doesn’t sound appealing. So where am I going with this?

When you take a second to do that math, both portfolios ended up at nearly the same place after 7 years. Up nearly 45% at the end of 2007. So what gives? Why not just buy the S&P 500 with the hopes of outsized returns? I would contend that watching your portfolio draw down 37% in from 2000-2002 is not an endeavor for the faint of heart. It’s incredibly difficult to watch your money evaporate and fight the inkling to sell, sell, sell. Being down 13% in a diversified portfolio isn’t a wonderful feeling either but looking at your losses in dollar terms you may not feel as emotionally inclined to sell. Moreover, for someone who is retired, you are dramatically reducing your risk of needing to withdrawal at an inopportune time. When your withdrawing money in retirement, you would prefer to avoid large losses when you also need to withdraw from your portfolio. Taking money out when it is also disappearing in a down market is not a recipe for success.

This year so far isn’t what any investor wishes for. The economy continues to grow, and the economic fundamentals are quite solid, but the market isn’t moving in the same direction. It happens. But what we do know, and what the evidence shows is that a diversified portfolio may lead you on a smoother path over the long-term. It isn’t the big winner year in and year out, but you hopefully avoid being the big loser. As we enter the New Year, it might be time to re-visit just how diversified your portfolio is, and what risk you are taking in the shorter term.

The views are those of Robert Jeter CFP ®, CRPC and should not be construed as specific investment advice. Robert regularly speaks to the public on behavioral finance and how it affects investment decisions. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Investors cannot directly invest in indices. Past performance is not a guarantee of future results.

Investments in securities do not offer a fixed rate of return. Principal, yield and/or share price will fluctuate with changes in market conditions and, when sold or redeemed, you may receive more or less than originally invested. No system or financial planning strategy can guarantee future results. A diversified portfolio does not assure a profit or protect against loss in a declining market.

Securities and advisory serviced offered through Cetera Advisors LLC, member FINRA/SIPC. Cetera is under separate ownership from any other named entity.