The title is a little misleading. In investing, it can be a bit of a misnomer that if the price of an asset increases substantially, it becomes “due” for a drop. That said, it isn’t necessarily the just the “price” of the asset increasing, but the valuation that is important to pay attention to. And when you take a look at valuations, what can be a misnomer, becomes true more often than not. Which brings us to this year. Markets so far in 2022 have had a rough start, and we wanted to take a look at what has been driving market performance so far this year.

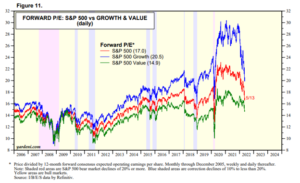

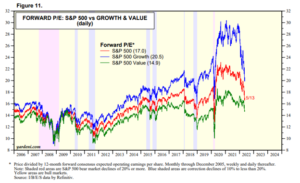

To start, we can look at valuations of large-cap U.S. stocks. Below is a chart of the forward Price to Earnings ratios of Large-cap Growth, blend and value stocks.

You’ll notice one of these lines isn’t like the rest. That blue line, is U.S. large-cap growth stocks. Their price to earnings ratios had grown substantially starting immediately following the pandemic. As a primer, the price to earnings ratio of the price of one share of stock divided by how much earnings a company generates per share of stock. We use this as one determinant of how over-valued or under valued segments of the market may be. The P/E of U.S. large-cap stocks grew significantly in the months following the pandemic. Said another way, these stocks became quite expensive. As you can probably tell, well over their historical norms. The price of these companies continued to grow well in excess of the growth in earnings the company was generating. That isn’t healthy. One of the things that can cause valuations to drop or reset, is interest rates. And that is precisely what has happened to start the year. Below you can see the relative performance of these three asset groups.

Using a $10,000 initial portfolio value in 2021, you can see that only U.S. large-cap growth has returned to that level. Basically erasing all of the gains that had been made over the preceding 18 months. However, large-cap blend and value stocks remain positive and have dropped, but with a far less magnitude.

So, what is the story here? If valuations get overly expensive, what goes up may come down much closer to its historical averages. It isn’t necessarily just the “price” of a stock, as long as the underlying earnings support the growth. We analyze this frequently in allocating our clients assets. Many of you may remember the “tech bubble” of 1999-2000. It was a similar story of a wildly over-valued market. If you had bought those expensive stocks at the top of their valuation, it would have taken you nearly 10 years to recover your funds. The price you pay (valuation) matters greatly in your risk and return profile moving forward. What goes up, will likely come down to a more “normal” valuation, eventually.

*Investors cannot directly invest in indices. Past performance does not guarantee future results.